Portfolio Analytics

Built end-to-end analytics for mutual fund portfolios, transforming raw, cluttered data into clear visual insights that reveal what users are missing, reduce noise, and deliver tangible value.

your investments

43.12%

YTD

₹19,01,215.4

3M

6M

1Y

3Y

5Y

ALL

MAR 2024

Your Stacks

+8

₹ 19,20,210

Vault

+3

₹ 19,20,210

8 Funds underperforming

SIP center

Get Ultimate Power of SIP with Stack

₹15,000/m invested for 10 years

₹24.2L

12%

BENCHMARK

₹32.2L

17.2%

STACK WEALTH

aggressive portfolio with returns of 12.5%

Start an SIP

Trending categories

Best for SIP

Beat the markets with our smart portfolios powered by quant.

3y cagr upto

24.6%

Explore

Flexicap Kings

Beat the markets with our smart portfolios powered by quant.

3y cagr

24.6%

High ranking funds

Funds with NIFTY Beating Returns.

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Top Rated

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

Explore all

explore mutual funds

All Mutual Fund Categories

Best in SIP

Upto 24.6%

Index Investing

Upto 24.6%

Index Investing

24.6%

₹

₹

Fixed Income

Upto 24.6%

Best in SIP

Upto 24.6%

Best in SIP

24.6%

Explore All Funds

have questions?

Your Dedicated Wealth Team

certified

₹150 Cr

AUM

Schedule a Call

Investing can be rewarding.

Stack Wealth

13:13

stack wealth / 2023

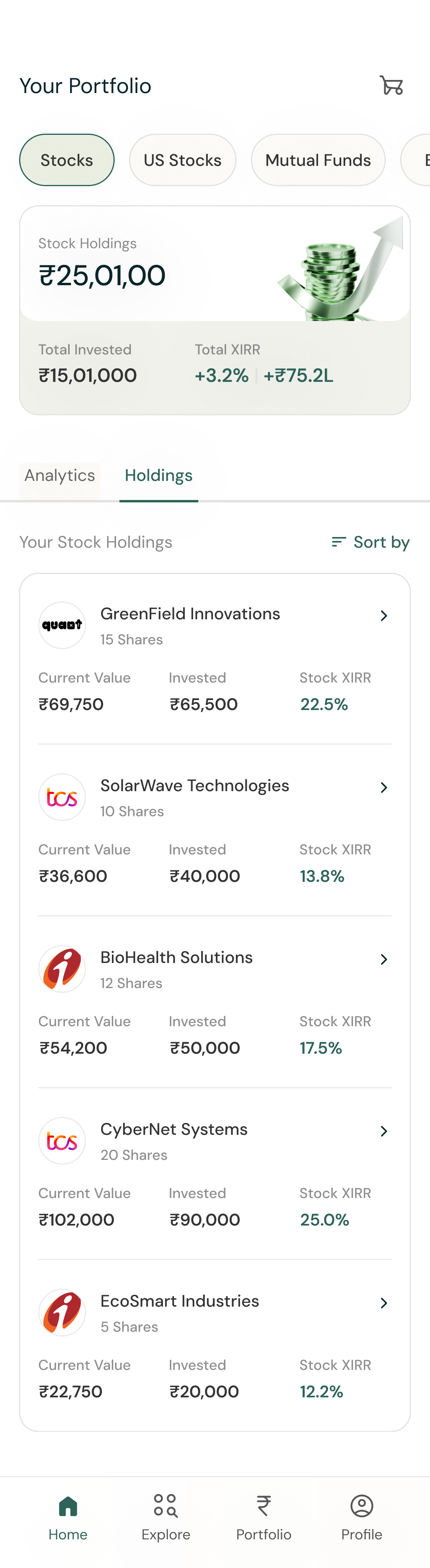

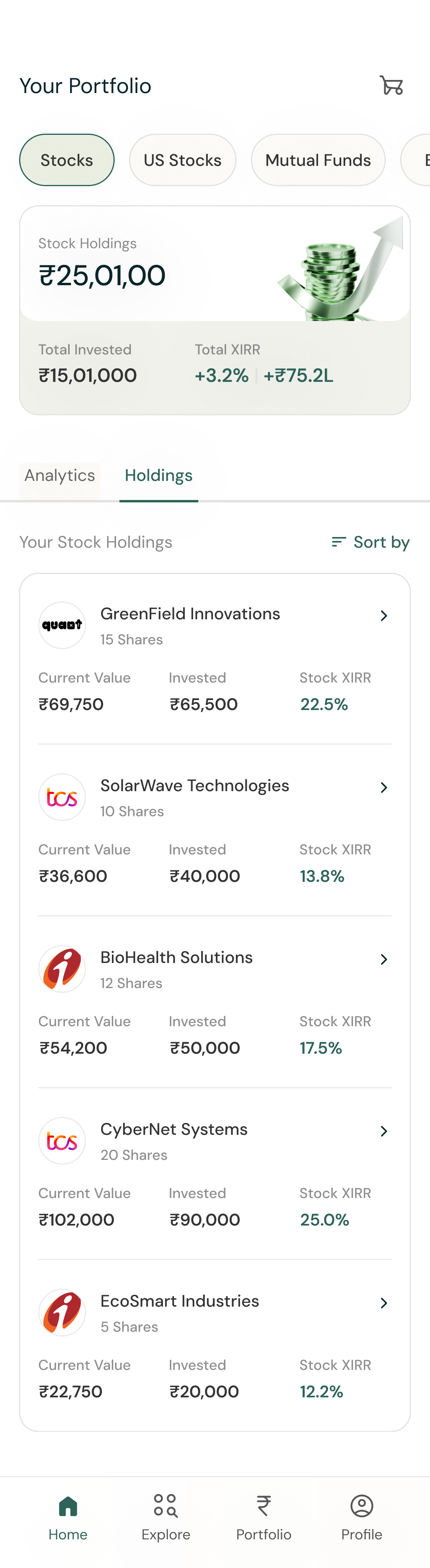

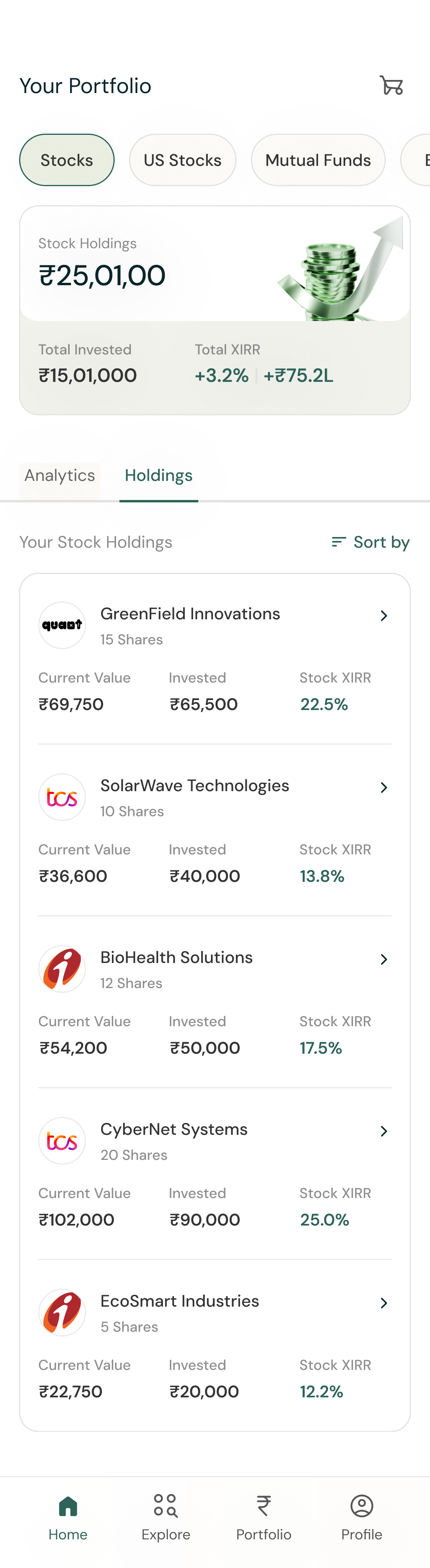

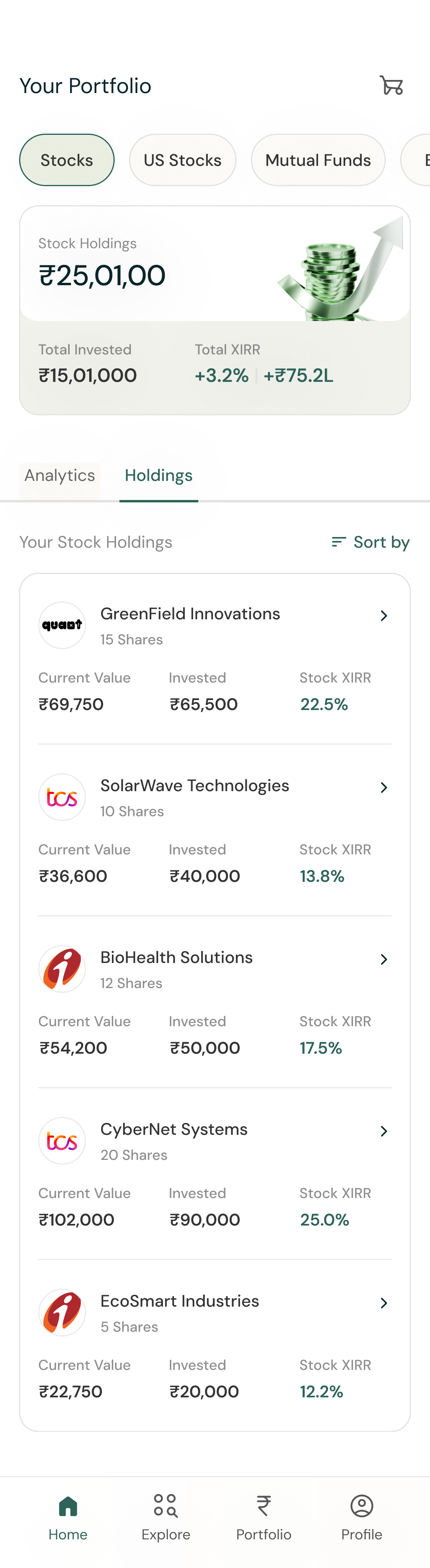

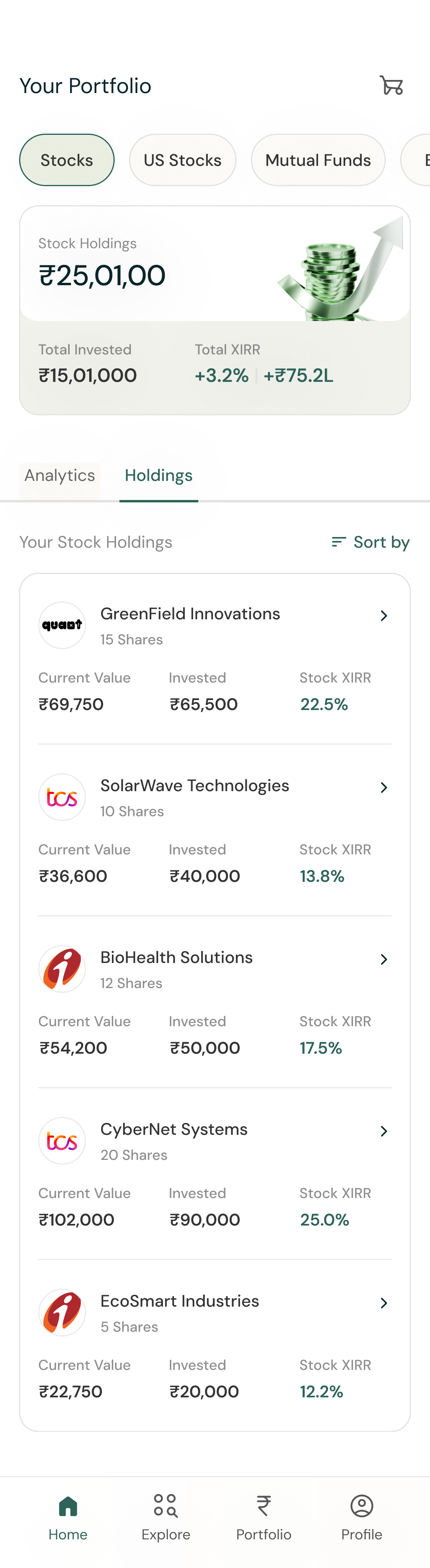

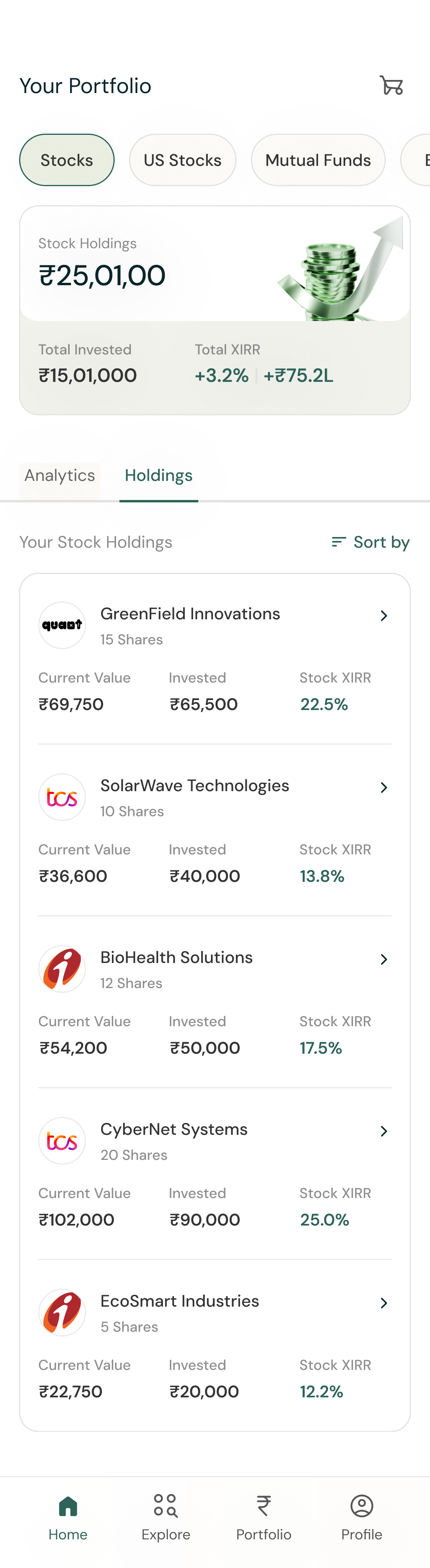

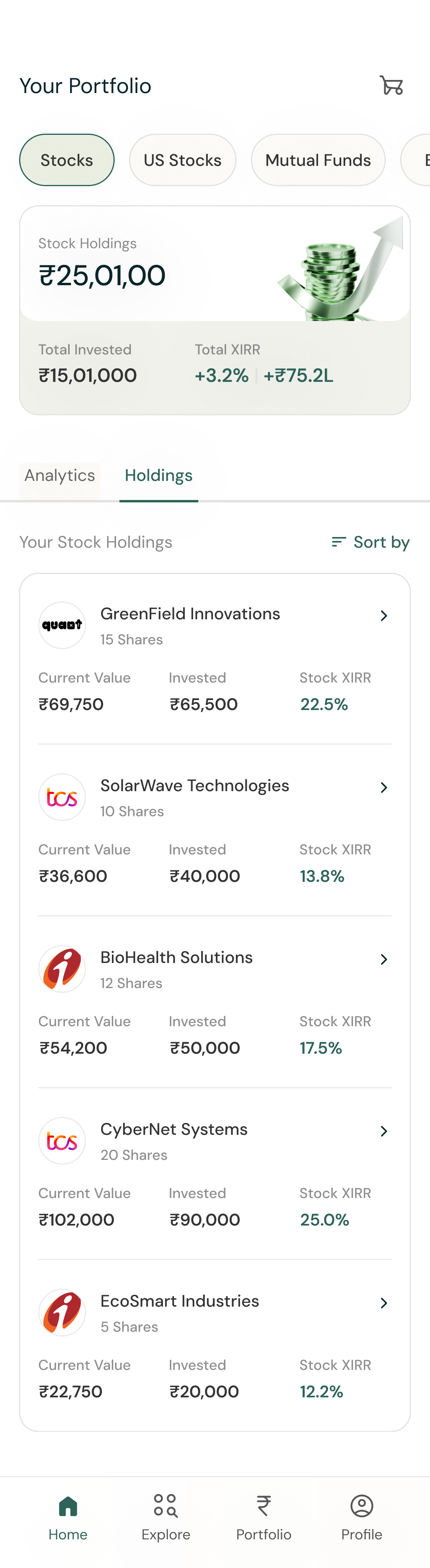

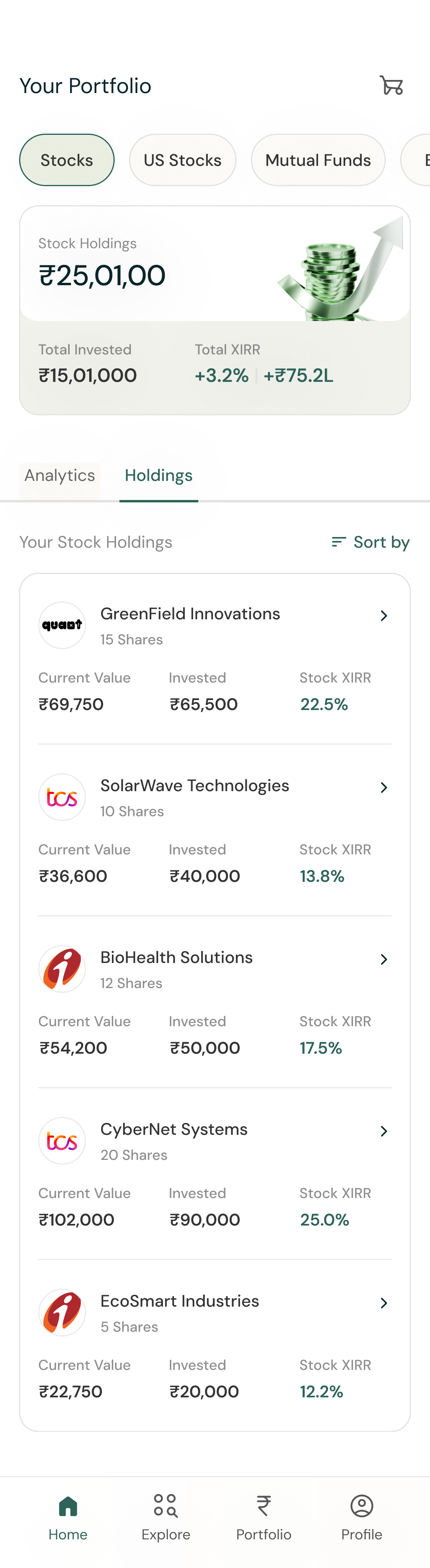

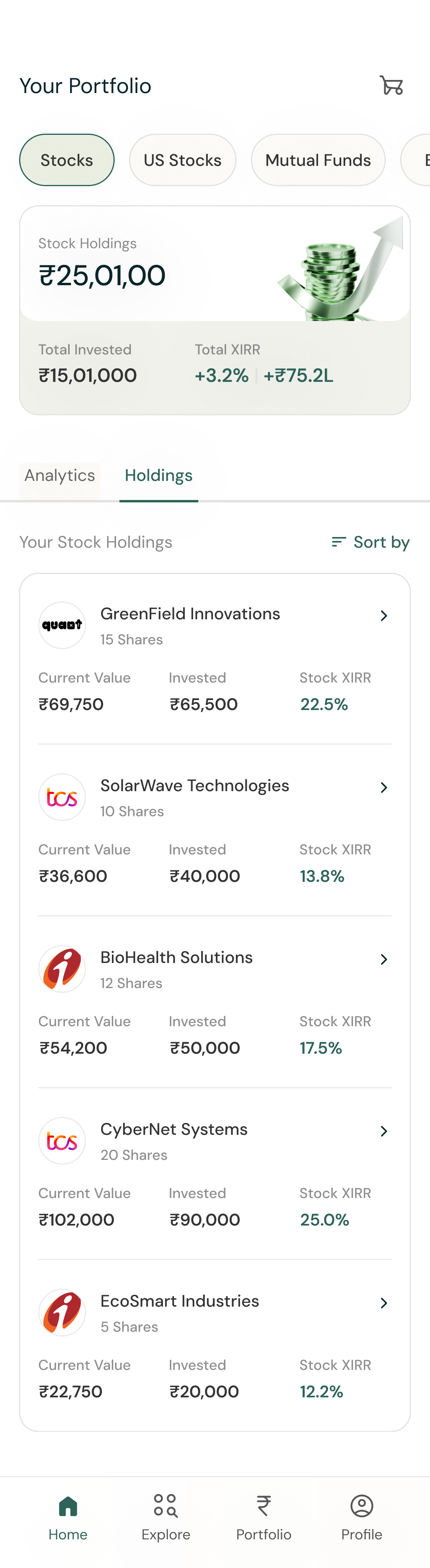

Stack Invest makes mutual fund investing simple and goal-driven, letting users buy, sell, and track portfolios in one place with metrics like XIRR, CAGR, and risk scores — all with clarity and transparency.

Role

Senior Product Designer

Risk, Return & Market

01/02

Risk vs. Return Representation visualizes whether the level of risk taken matches the returns achieved, giving users clarity on the efficiency of their investments.

Returns

Risk

discipline

Companies

risk vs return

high return

low risk

high risk

low return

risk metrics

Standard Deviation

this fund

23.39%

vs

benchmark

37.9%

higher the better

Downside Risk

this fund

23.39%

vs

benchmark

37.9%

higher the better

Beta

this fund

23.39%

vs

benchmark

37.9%

lower the better

risk adjusted returns

6 funds have bad risk adjusted returns.

XIRR 23.39% < 37.9% BM XIRR

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

High Risk

XIRR 23.39% < 37.9% BM XIRR

UTI Nifty Next 50 Index Fund

Equity

Thematic

High Risk

XIRR 23.39% < 37.9% BM XIRR

Parag Parikh ELSS Tax Saver Fund Regular

Equity

Thematic

High Risk

View All

13:13

Portfolio Alpha shows how an investor’s performance compares to the market, helping them understand if their strategy is truly adding value.

Time in Market highlights how consistently users stay invested and how they react during volatility, such as buying or selling during market dips.

this fund

23.39%

vs

benchmark

37.9%

higher the better

1Y

3Y

5Y

7Y

16%

21%

12%

12%

24%

19.2%

23%

23%

higher the better

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

india’s demonetisation - dec 2016

withdrawn

-₹2,28,000

Analytics Breakdown

02/02

Performance insights highlight how each fund compares against its benchmark, making it easy to identify underperformers and understand whether a fund is truly adding value. This clarity helps users move beyond raw returns and focus on meaningful outcomes.

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

this fund

23.39%

vs

benchmark

37.9%

This fund is underperforming for the last 3 years than benchmark.

low risk

high return

low risk

low return

high risk

high return

high risk

low return

benchmark

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

Mid Risk

Help

You could’ve gained ₹2,43,901 if you’ve invested in Stack

your returns

₹1,78,982

vs

stack returns

₹4,03,892

How do we calculate this?

underperforming funds

8 out of 19 funds are underperforming

XIRR 23.39% < 37.9% BM XIRR

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

XIRR 23.39% < 37.9% BM XIRR

UTI Nifty Next 50 Index Fund

Equity

Thematic

XIRR 23.39% < 37.9% BM XIRR

Parag Parikh ELSS Tax Saver Fund Regular

Equity

Thematic

View All

13:13

Overlap analysis brings transparency to portfolio construction by showing how much two funds share in common. By surfacing these redundancies, users can make smarter diversification choices and ensure their investments are working efficiently.

Exit recommendations provide clear guidance on which funds may no longer align with user goals. With actionable insights and context, investors can confidently rebalance their portfolios and stay on track with their long-term strategies.

Parag Parikh ELSS Tax Saver Fund Regular

fund 2

Nippon India Large

Cap Fund - Direct Plan

52.2%

overlap

42.1%

exit these funds

₹25,000

EXIT

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

₹19,000

EXIT

UTI Large Cap Fund - Direct Plan

Equity

Thematic

Portfolio Analytics

Built end-to-end analytics for mutual fund portfolios, transforming raw, cluttered data into clear visual insights that reveal what users are missing, reduce noise, and deliver tangible value.

your investments

43.12%

YTD

₹19,01,215.4

3M

6M

1Y

3Y

5Y

ALL

MAR 2024

Your Stacks

+8

₹ 19,20,210

Vault

+3

₹ 19,20,210

8 Funds underperforming

SIP center

Get Ultimate Power of SIP with Stack

₹15,000/m invested for 10 years

₹24.2L

12%

BENCHMARK

₹32.2L

17.2%

STACK WEALTH

aggressive portfolio with returns of 12.5%

Start an SIP

Trending categories

Best for SIP

Beat the markets with our smart portfolios powered by quant.

3y cagr upto

24.6%

Explore

Flexicap Kings

Beat the markets with our smart portfolios powered by quant.

3y cagr

24.6%

High ranking funds

Funds with NIFTY Beating Returns.

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Top Rated

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

Explore all

explore mutual funds

All Mutual Fund Categories

Best in SIP

Upto 24.6%

Index Investing

Upto 24.6%

Index Investing

24.6%

₹

₹

Fixed Income

Upto 24.6%

Best in SIP

Upto 24.6%

Best in SIP

24.6%

Explore All Funds

have questions?

Your Dedicated Wealth Team

certified

₹150 Cr

AUM

Schedule a Call

Investing can be rewarding.

Stack Wealth

13:13

stack wealth / 2023

Stack Invest makes mutual fund investing simple and goal-driven, letting users buy, sell, and track portfolios in one place with metrics like XIRR, CAGR, and risk scores — all with clarity and transparency.

Role

Senior Product Designer

Risk, Return & Market

01/02

Risk vs. Return Representation visualizes whether the level of risk taken matches the returns achieved, giving users clarity on the efficiency of their investments.

Returns

Risk

discipline

Companies

risk vs return

high return

low risk

high risk

low return

risk metrics

Standard Deviation

this fund

23.39%

vs

benchmark

37.9%

higher the better

Downside Risk

this fund

23.39%

vs

benchmark

37.9%

higher the better

Beta

this fund

23.39%

vs

benchmark

37.9%

lower the better

risk adjusted returns

6 funds have bad risk adjusted returns.

XIRR 23.39% < 37.9% BM XIRR

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

High Risk

XIRR 23.39% < 37.9% BM XIRR

UTI Nifty Next 50 Index Fund

Equity

Thematic

High Risk

XIRR 23.39% < 37.9% BM XIRR

Parag Parikh ELSS Tax Saver Fund Regular

Equity

Thematic

High Risk

View All

13:13

Portfolio Alpha shows how an investor’s performance compares to the market, helping them understand if their strategy is truly adding value.

Time in Market highlights how consistently users stay invested and how they react during volatility, such as buying or selling during market dips.

this fund

23.39%

vs

benchmark

37.9%

higher the better

1Y

3Y

5Y

7Y

16%

21%

12%

12%

24%

19.2%

23%

23%

higher the better

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

india’s demonetisation - dec 2016

withdrawn

-₹2,28,000

Analytics Breakdown

02/02

Performance insights highlight how each fund compares against its benchmark, making it easy to identify underperformers and understand whether a fund is truly adding value. This clarity helps users move beyond raw returns and focus on meaningful outcomes.

Equity

Thematic

this fund

23.39%

vs

benchmark

37.9%

This fund is underperforming for the last 3 years than benchmark.

low risk

high return

low risk

low return

high risk

high return

high risk

low return

benchmark

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

Mid Risk

Help

You could’ve gained ₹2,43,901 if you’ve invested in Stack

your returns

₹1,78,982

vs

stack returns

₹4,03,892

How do we calculate this?

underperforming funds

8 out of 19 funds are underperforming

XIRR 23.39% < 37.9% BM XIRR

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

XIRR 23.39% < 37.9% BM XIRR

UTI Nifty Next 50 Index Fund

Equity

Thematic

XIRR 23.39% < 37.9% BM XIRR

Parag Parikh ELSS Tax Saver Fund Regular

Equity

Thematic

View All

13:13

Overlap analysis brings transparency to portfolio construction by showing how much two funds share in common. By surfacing these redundancies, users can make smarter diversification choices and ensure their investments are working efficiently.

Exit recommendations provide clear guidance on which funds may no longer align with user goals. With actionable insights and context, investors can confidently rebalance their portfolios and stay on track with their long-term strategies.

Parag Parikh ELSS Tax Saver Fund Regular

fund 2

Nippon India Large

Cap Fund - Direct Plan

52.2%

overlap

42.1%

exit these funds

₹25,000

EXIT

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

₹19,000

EXIT

UTI Large Cap Fund - Direct Plan

Equity

Thematic

Portfolio Analytics

Built end-to-end analytics for mutual fund portfolios, transforming raw, cluttered data into clear visual insights that reveal what users are missing, reduce noise, and deliver tangible value.

your investments

43.12%

YTD

₹19,01,215.4

3M

6M

1Y

3Y

5Y

ALL

MAR 2024

Your Stacks

+8

₹ 19,20,210

Vault

+3

₹ 19,20,210

8 Funds underperforming

SIP center

Get Ultimate Power of SIP with Stack

₹15,000/m invested for 10 years

₹24.2L

12%

BENCHMARK

₹32.2L

17.2%

STACK WEALTH

aggressive portfolio with returns of 12.5%

Start an SIP

Trending categories

Best for SIP

Beat the markets with our smart portfolios powered by quant.

3y cagr upto

24.6%

Explore

Flexicap Kings

Beat the markets with our smart portfolios powered by quant.

3y cagr

24.6%

High ranking funds

Funds with NIFTY Beating Returns.

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Top Rated

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

48.24 (3Y CAGR)

UTI Nifty Next 50 Index Fund

Equity

Thematic

Explore all

explore mutual funds

All Mutual Fund Categories

Best in SIP

Upto 24.6%

Index Investing

Upto 24.6%

Index Investing

24.6%

₹

₹

Fixed Income

Upto 24.6%

Best in SIP

Upto 24.6%

Best in SIP

24.6%

Explore All Funds

have questions?

Your Dedicated Wealth Team

certified

₹150 Cr

AUM

Schedule a Call

Investing can be rewarding.

Stack Wealth

13:13

stack wealth / 2023

Stack Invest makes mutual fund investing simple and goal-driven, letting users buy, sell, and track portfolios in one place with metrics like XIRR, CAGR, and risk scores — all with clarity and transparency.

Role

Senior Product Designer

Risk, Return & Market

01/02

Risk vs. Return Representation visualizes whether the level of risk taken matches the returns achieved, giving users clarity on the efficiency of their investments.

Returns

Risk

discipline

Companies

risk vs return

high return

low risk

high risk

low return

risk metrics

Standard Deviation

this fund

23.39%

vs

benchmark

37.9%

higher the better

Downside Risk

this fund

23.39%

vs

benchmark

37.9%

higher the better

Beta

this fund

23.39%

vs

benchmark

37.9%

lower the better

risk adjusted returns

6 funds have bad risk adjusted returns.

XIRR 23.39% < 37.9% BM XIRR

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

High Risk

XIRR 23.39% < 37.9% BM XIRR

UTI Nifty Next 50 Index Fund

Equity

Thematic

High Risk

XIRR 23.39% < 37.9% BM XIRR

Parag Parikh ELSS Tax Saver Fund Regular

Equity

Thematic

High Risk

View All

13:13

Portfolio Alpha shows how an investor’s performance compares to the market, helping them understand if their strategy is truly adding value.

Time in Market highlights how consistently users stay invested and how they react during volatility, such as buying or selling during market dips.

this fund

23.39%

vs

benchmark

37.9%

higher the better

returns

1Y

3Y

5Y

7Y

this fund

16%

21%

12%

12%

benchmark

24%

19.2%

23%

23%

higher the better

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

india’s demonetisation - dec 2016

withdrawn

-₹2,28,000

Analytics Breakdown

02/02

Performance insights highlight how each fund compares against its benchmark, making it easy to identify underperformers and understand whether a fund is truly adding value. This clarity helps users move beyond raw returns and focus on meaningful outcomes.

Equity

Thematic

this fund

23.39%

vs

benchmark

37.9%

This fund is underperforming for the last 3 years than benchmark.

low risk

high return

low risk

low return

high risk

high return

high risk

low return

benchmark

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

Mid Risk

Help

You could’ve gained ₹2,43,901 if you’ve invested in Stack

your returns

₹1,78,982

vs

stack returns

₹4,03,892

How do we calculate this?

underperforming funds

8 out of 19 funds are underperforming

XIRR 23.39% < 37.9% BM XIRR

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

XIRR 23.39% < 37.9% BM XIRR

UTI Nifty Next 50 Index Fund

Equity

Thematic

XIRR 23.39% < 37.9% BM XIRR

Parag Parikh ELSS Tax Saver Fund Regular

Equity

Thematic

View All

13:13

Overlap analysis brings transparency to portfolio construction by showing how much two funds share in common. By surfacing these redundancies, users can make smarter diversification choices and ensure their investments are working efficiently.

Exit recommendations provide clear guidance on which funds may no longer align with user goals. With actionable insights and context, investors can confidently rebalance their portfolios and stay on track with their long-term strategies.

fund 1

Parag Parikh ELSS Tax Saver Fund Regular

fund 2

Nippon India Large

Cap Fund - Direct Plan

52.2%

overlap

42.1%

exit these funds

₹25,000

EXIT

Nippon India Large Cap Fund - Direct Plan

Equity

Thematic

₹19,000

EXIT

UTI Large Cap Fund - Direct Plan

Equity

Thematic