Custom Strategies

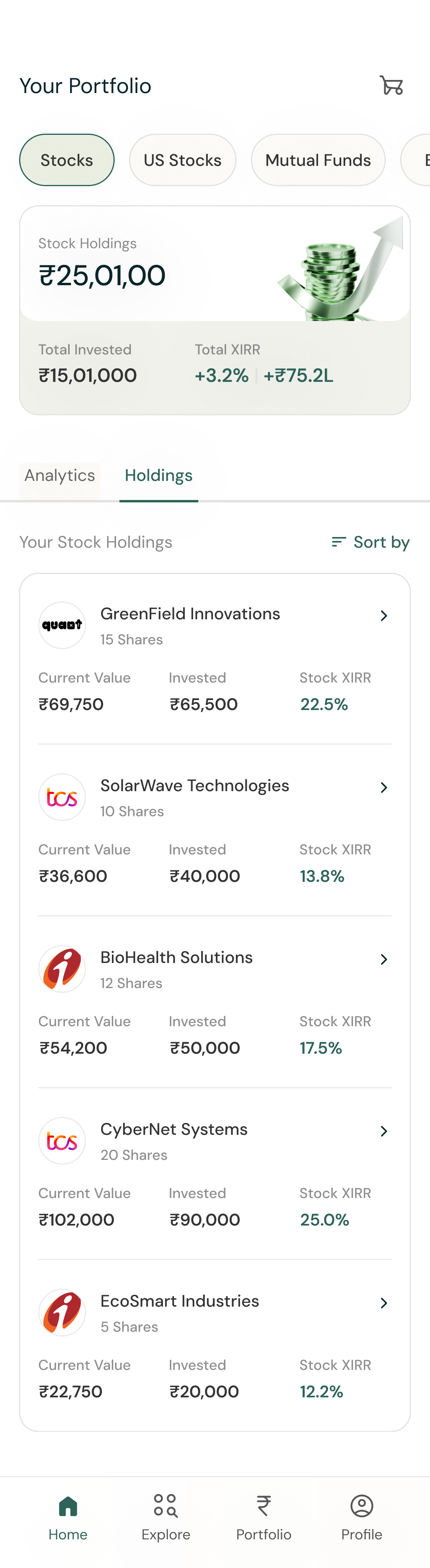

Built an AI-powered system that delivers personalized investment strategies based on individual preferences and goals, while driving higher product engagement and improving user session flow.

Mar 2024

Nov 2020

Long-Term

The Portfolio targets medium to long-term growth by investing in global leaders in sectors like AI, EVs, and Renewables.

Performance

Investments

Rebalances

Managed by

Facts

Performance vs Benchmarks

INR

USD

Our Strategy (Global Leaders)

6.12%

4.93%

3.10%

S&P 500

NIFTY 50

1M

YTD

1Y

3Y

Inception

Buy Recommendations

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+75%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

View all

Metrics

P/E Ratio

Portfolio

2.38%

Nifty500

1.8%

-10%

10%

higher the better

ROCE (%)

Portfolio

-2.38%

Nifty500

1.8%

-10%

10%

higher the better

Price/Book Ratio

Portfolio

1.5

Nifty500

0.9

-20%

15%

lower the better

Current Ratio

Portfolio

1.8

Nifty500

1.2

+5%

10%

higher the better

Net Profit Margin (%)

Portfolio

5.0%

Nifty500

4.0%

+15%

20%

higher the better

Sector Split of this Strategy

Sectors

Sector Wise Break-up

Technology

53%

Healthcare

11%

Consumer Discretionary

25%

View Split

Recent Calls

Stable assets are low-volatility investments that provide steady returns.

MAR 2023

Exit

HDFC Bank Ltd

Portfolio Profit

+24%

MAR 2023

Buy

HDFC Bank Ltd

Upside

+24%

JAN 2024

HDFC Bank Something Ltd

Allocation

-24%

JAN 2024

HDFC Bank Something Ltd

- 2%

View all

Managed by

Ketul Sakhpara

25+ years experience

registered

Ketul Sakhpara, CFA is the Founder of BayFort Capital with over 20 years of experience. Read More

Niranjan

10+ years experience

registered

₹150 Cr

AUM

HDFC Bank Limited is a prominent private bank in India, offering a wide range. Read More

Why Invest in global leaders?

Global Growth

Invest in high-growth sectors like AI, EV, Biotech, and Robotics through a focused global portfolio not available in traditional domestic funds.

Innovation Driven

Gain access to innovation-driven global stocks aligned with themes like “Data is the New Oil,” offering opportunities beyond local markets.

Expert Review & Rebalancing

Every basket is reviewed by investment experts and rebalanced periodically to stay aligned with market shifts and investor goals.

Transparent & Trackable

Each basket is SEBI-compliant, performance-tracked, and easy to monitor from your dashboard.

Portfolio Facts

Lock-in Period

None

Annual Management Fee

2.5% (Incl. GST)

Min. Initial Investment

₹ 10 Lacs

Min. Additional Investment

₹ 85,000

Market Cap. Restriction

Above $10 Billion

Get Your

AI-Powered Portfolio

Get Portfolio

13:13

stack wealth / 2025

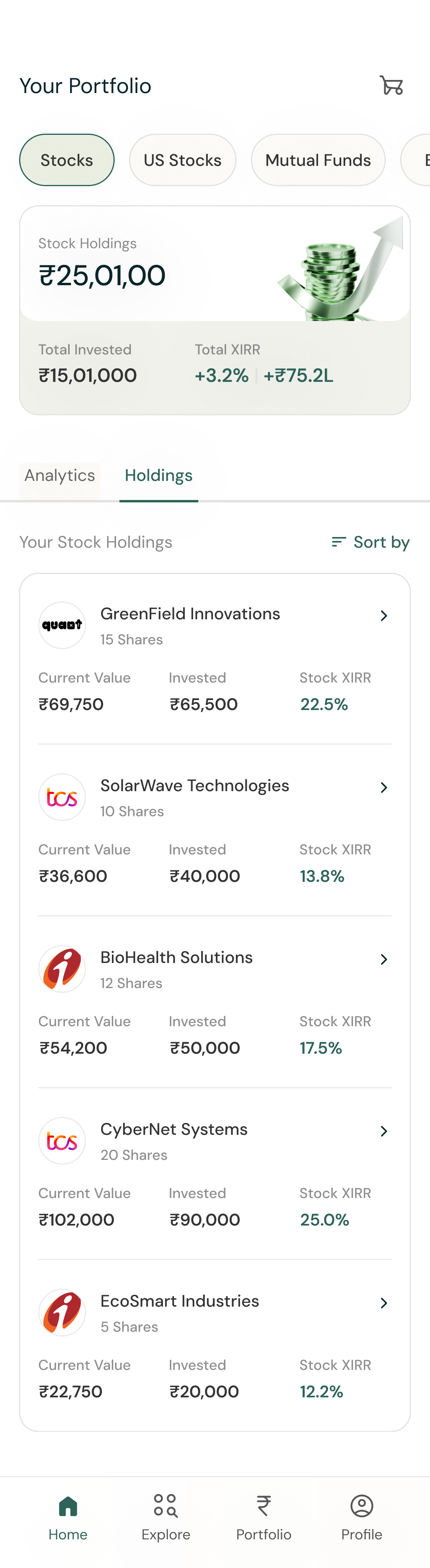

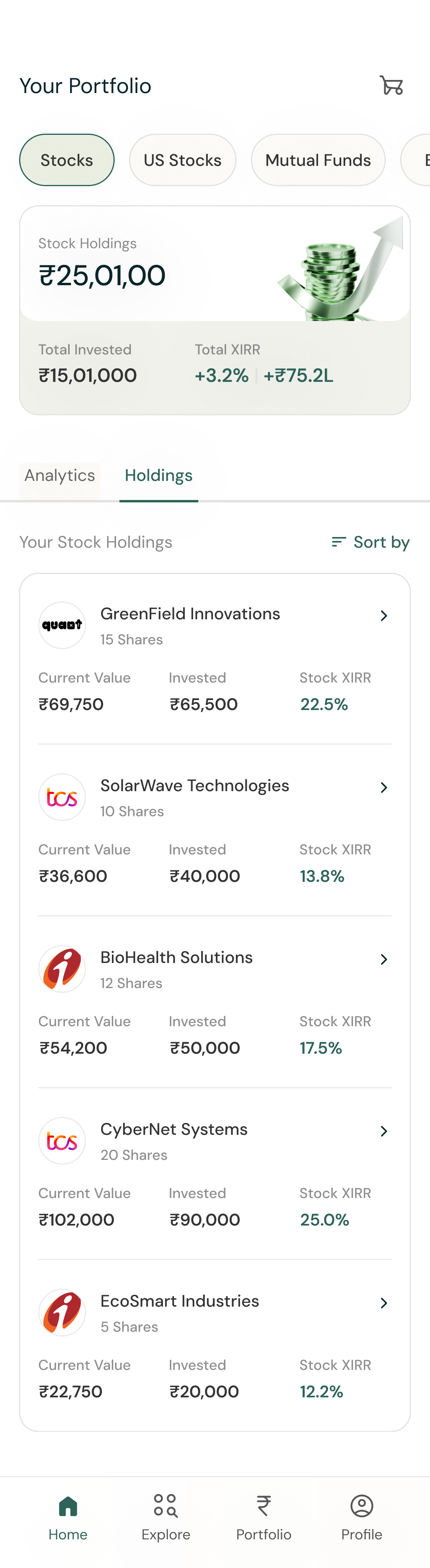

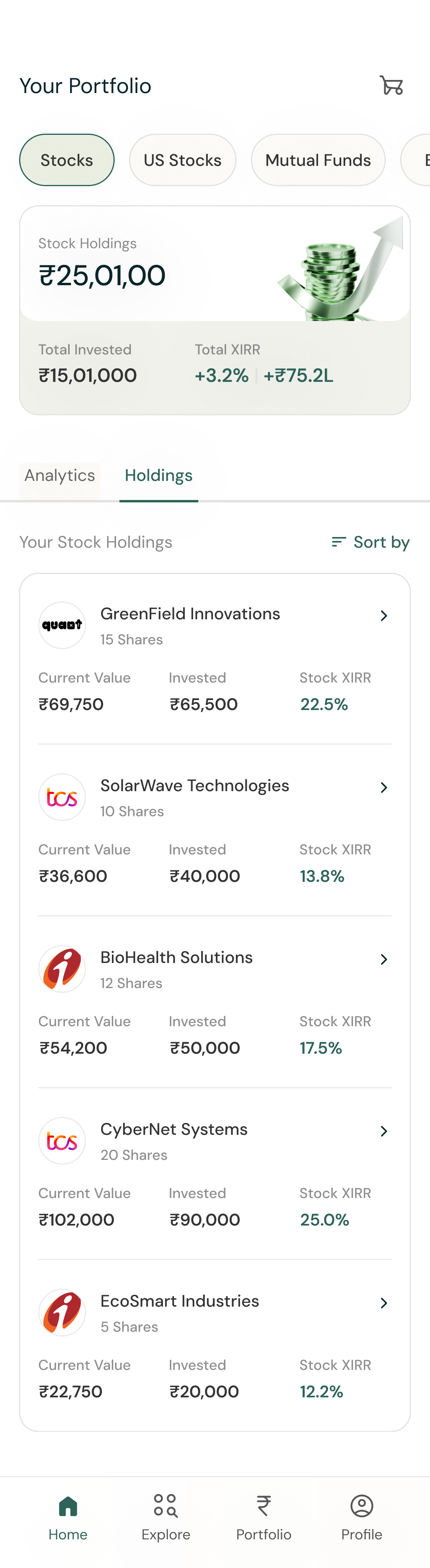

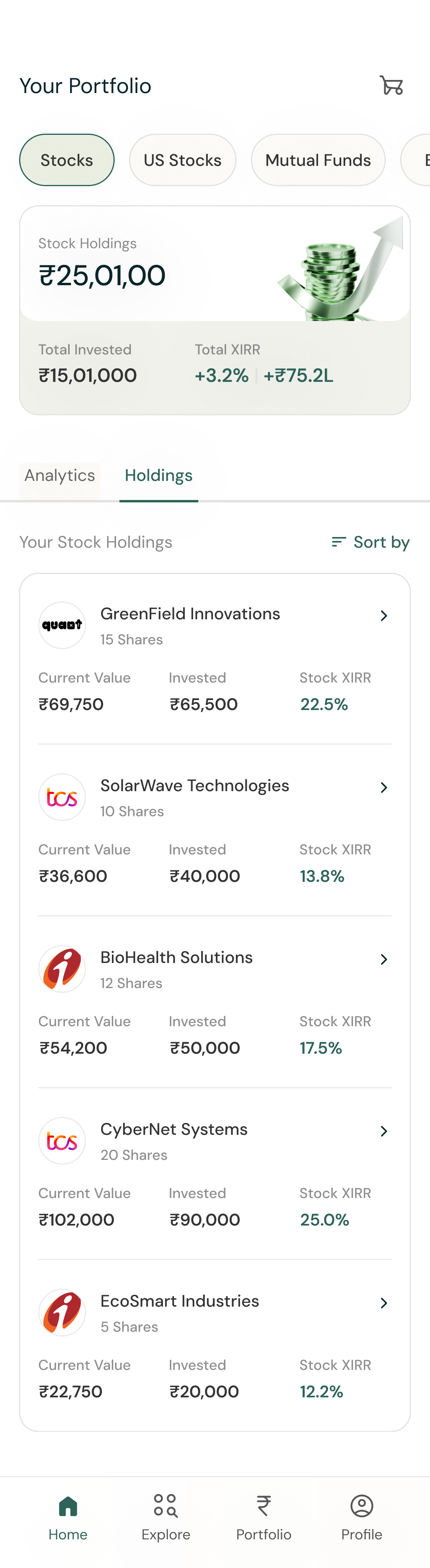

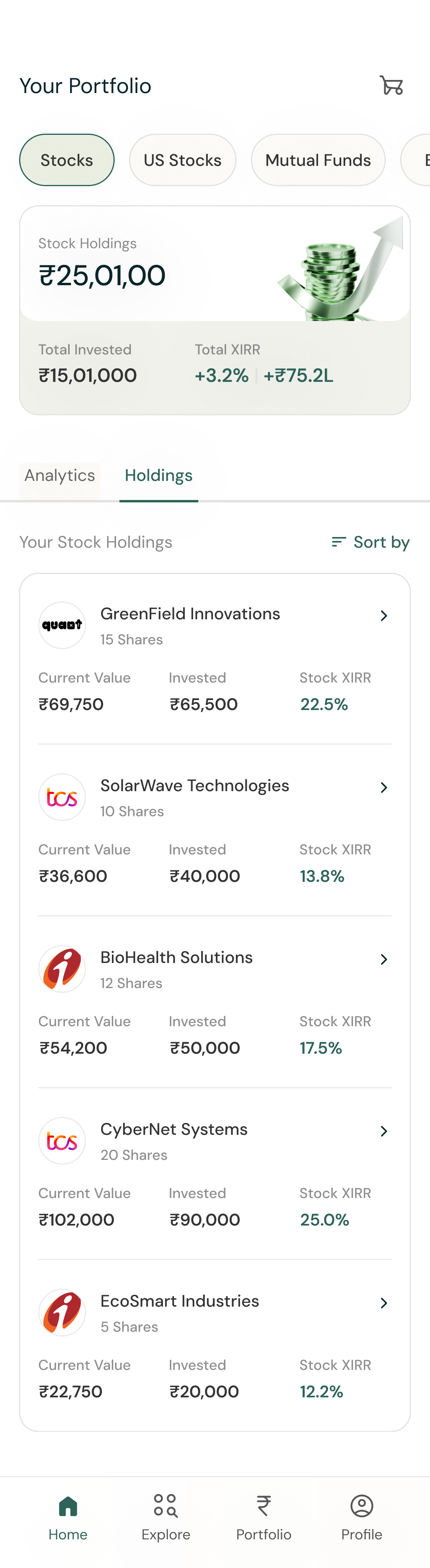

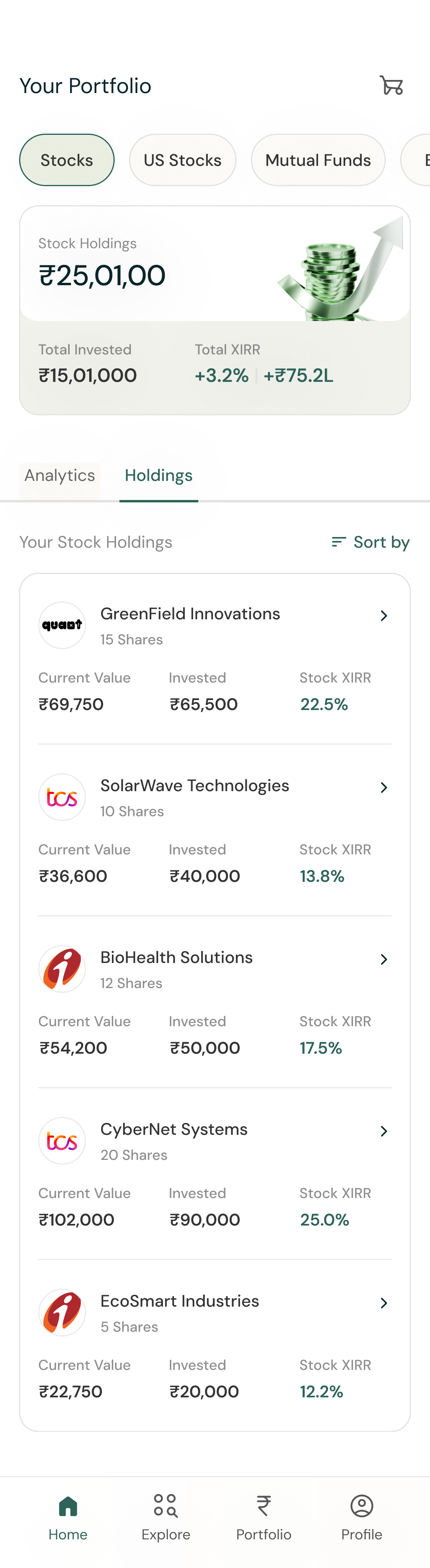

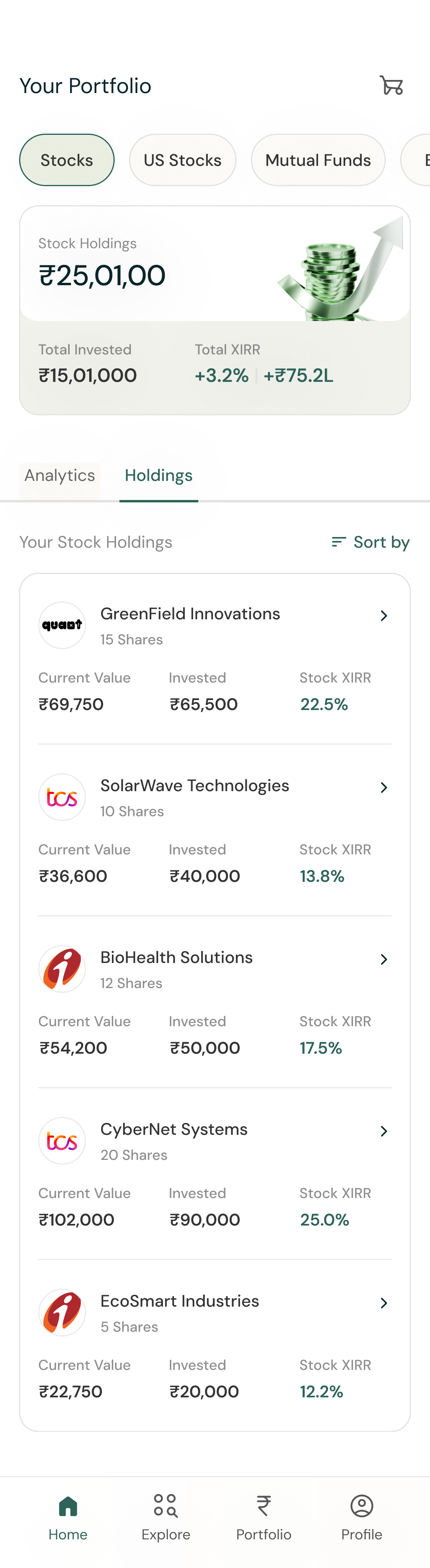

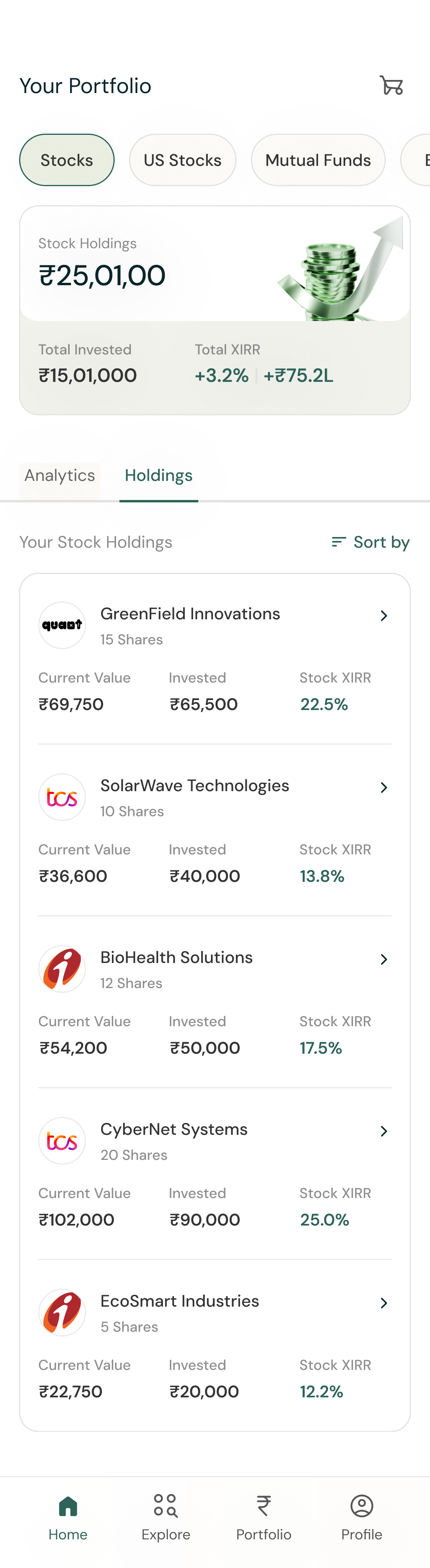

Stack Wealth is an AI powered wealth management platform that simplifies finance management. It helps users make better decisions with personalised recommendations and a unified portfolio view.

Role

Lead Product Designer

Investment Purpose Statement

01/02

The Investment Purpose Statement (IPS) turns simple inputs into a meaningful financial profile. Instead of focusing only on numbers, it interprets the intentions behind decisions, capturing the why as much as the what.

By mapping goals like long-term growth, vacations, or liquidity needs, the IPS organizes scattered inputs into clear, structured insights. It connects everyday choices to broader financial objectives.

The result is a personalized profile that reflects both financial behavior and life goals, ensuring strategies feel relevant, motivating, and actionable.

Your investments should align with your life goals

Tell us what you're planning for—whether it's early retirement, a new car, or a dream vacation. We'll help you invest accordingly.

Select your goals

13:13

Do you need to withdraw this money anytime soon?

Tell us what you're planning for—whether it's early retirement, a new car, or a dream vacation. We'll help you invest accordingly.

Select your goals

13:13

Strategies

02/02

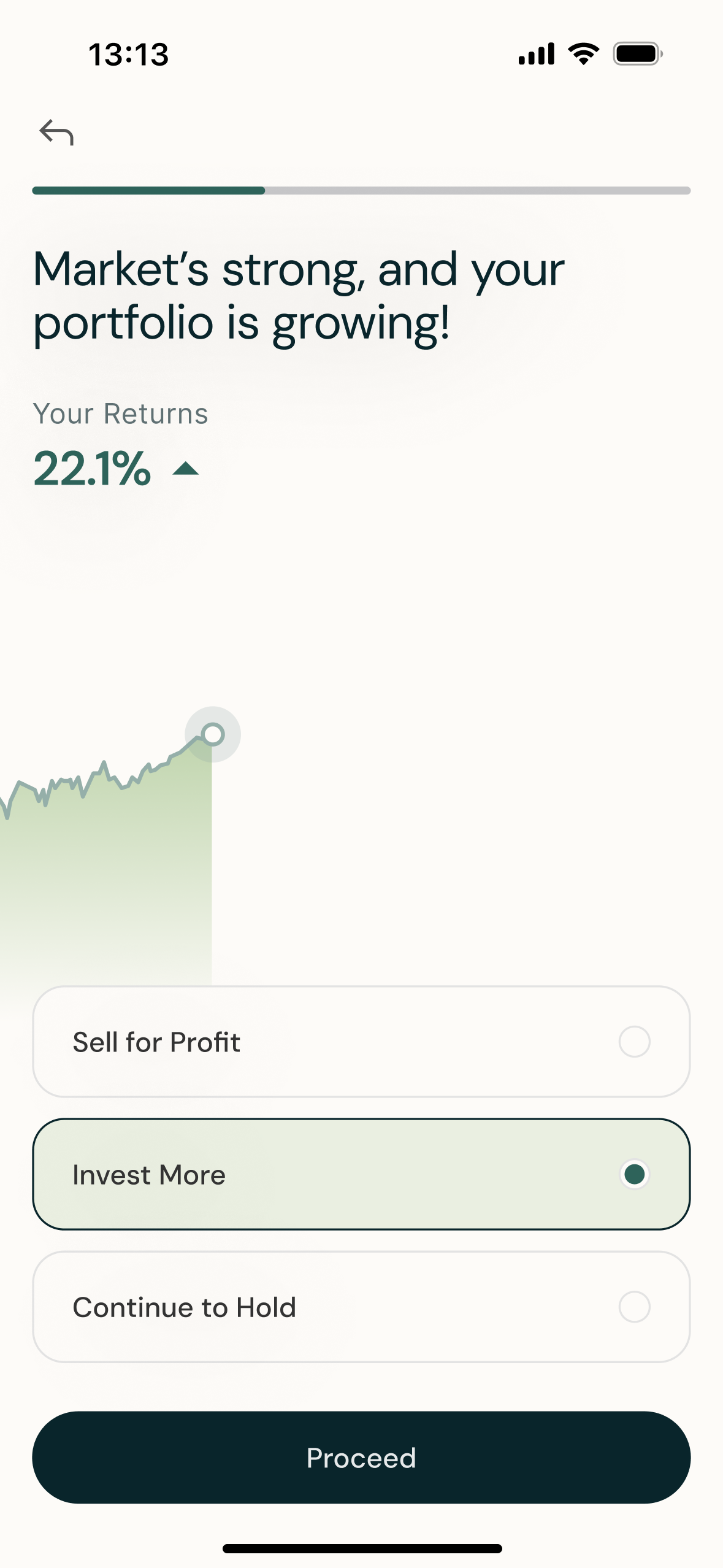

Based on each profile, users receive personalized strategies that turn their goals into clear direction. Flagship builds a balanced foundation, Global Leaders drives international growth, and Opportunity captures high-potential emerging trends.

Flagship

Strategy

Flagship is your core portfolio to achieve long-term wealth growth for you.

CAGR

22.4%

Min. Investment

₹ 35,000

Global Leaders

Strategy

With Global Leaders, you can invest in global stocks and diversify your portfolio.

CAGR

22.4%

Starting from

₹ 50,000

Opportunity Strategy

Invest in AI, Green Energy, and Tech innovations for long-term portfolio success.

CAGR

22.4%

Starting from

₹ 25,000

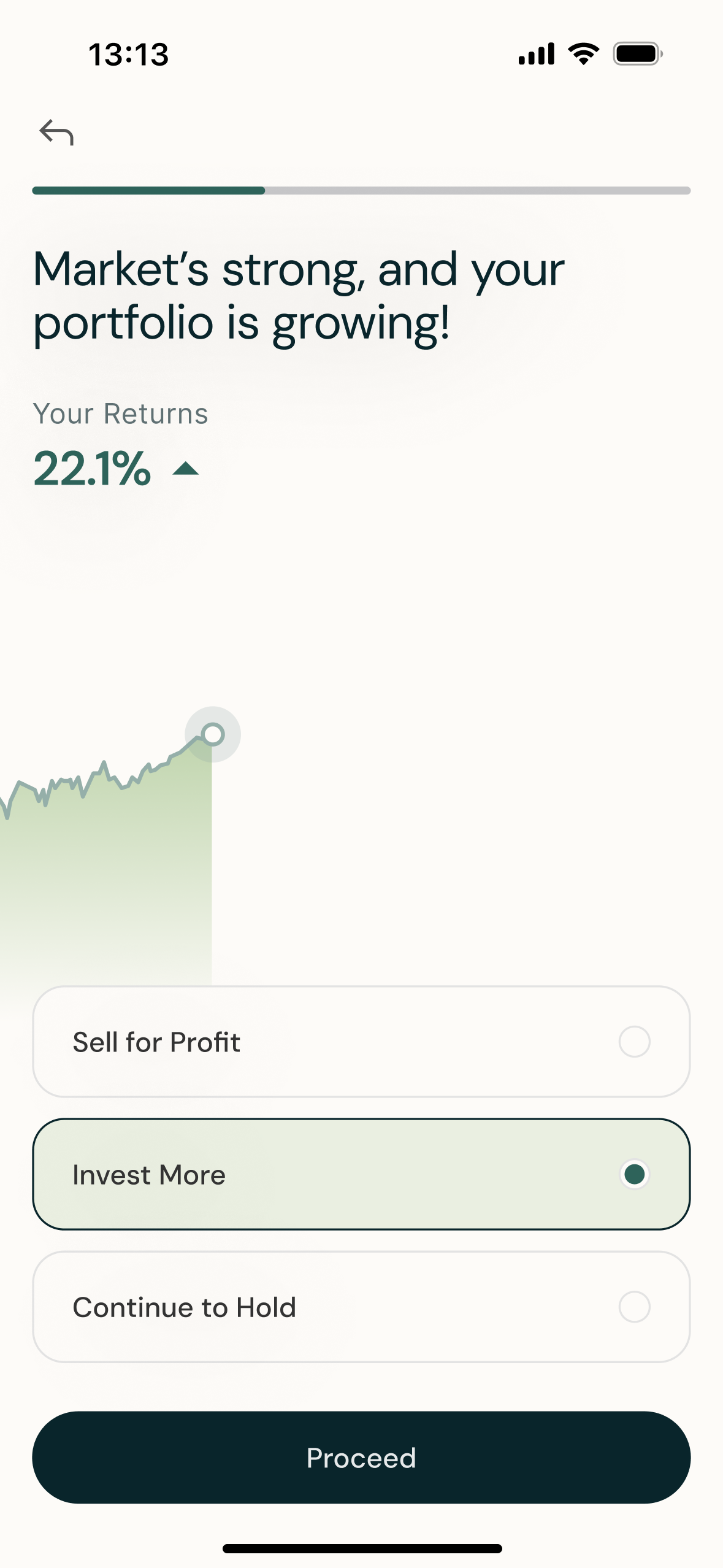

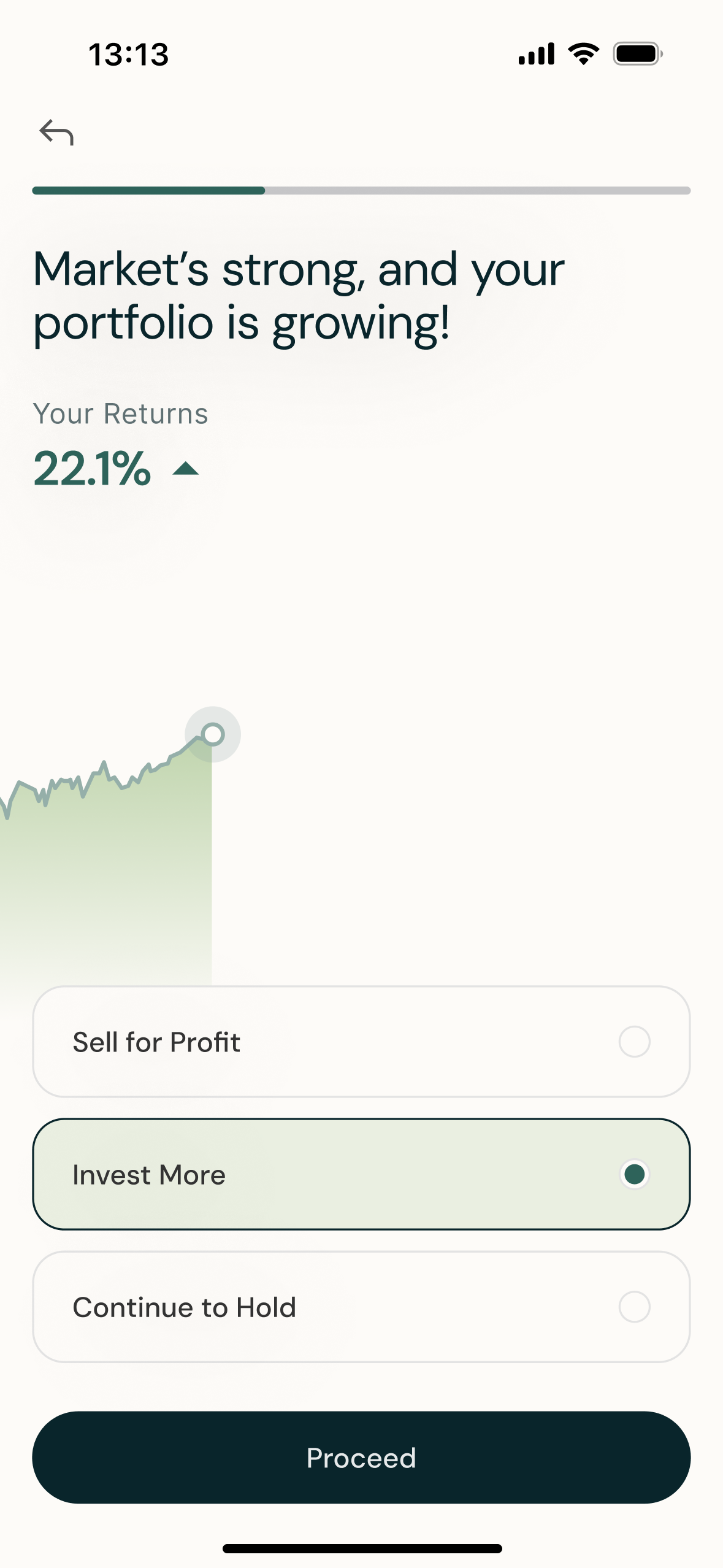

Each strategy comes with tailored investment recommendations aligned to the IPS. Long-term investors may see equity-heavy options, while those prioritizing liquidity get safer, flexible choices — all showing how each decision supports their goals.

Strategies also rebalance over time. As markets or personal needs change, portfolios are adjusted to stay aligned, reducing risks and keeping investments optimized for performance.

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+63%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹13700-15200

Review Range (3Y)

₹3059-3259

HDFC Bank Ltd

Buy

Upside

+24%

HDFC Bank Ltd

Exit

Portfolio Booked

+24%

MAR 2025

jan 2025

Custom Strategies

Built an AI-powered system that delivers personalized investment strategies based on individual preferences and goals, while driving higher product engagement and improving user session flow.

Long-Term

The Portfolio targets medium to long-term growth by investing in global leaders in sectors like AI, EVs, and Renewables.

Performance

Investments

Rebalances

Managed by

Facts

Performance vs Benchmarks

INR

USD

Our Strategy (Global Leaders)

6.12%

4.93%

3.10%

S&P 500

NIFTY 50

1M

YTD

1Y

3Y

Inception

Buy Recommendations

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+75%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

View all

Metrics

P/E Ratio

Portfolio

2.38%

Nifty500

1.8%

-10%

10%

higher the better

ROCE (%)

Portfolio

-2.38%

Nifty500

1.8%

-10%

10%

higher the better

Price/Book Ratio

Portfolio

1.5

Nifty500

0.9

-20%

15%

lower the better

Current Ratio

Portfolio

1.8

Nifty500

1.2

+5%

10%

higher the better

Net Profit Margin (%)

Portfolio

5.0%

Nifty500

4.0%

+15%

20%

higher the better

Sector Split of this Strategy

Sectors

Sector Wise Break-up

Technology

53%

Healthcare

11%

Consumer Discretionary

25%

View Split

Recent Calls

Stable assets are low-volatility investments that provide steady returns.

MAR 2023

Exit

HDFC Bank Ltd

Portfolio Profit

+24%

MAR 2023

Buy

HDFC Bank Ltd

Upside

+24%

JAN 2024

HDFC Bank Something Ltd

Allocation

-24%

JAN 2024

HDFC Bank Something Ltd

- 2%

View all

Managed by

Ketul Sakhpara

25+ years experience

registered

Ketul Sakhpara, CFA is the Founder of BayFort Capital with over 20 years of experience. Read More

Niranjan

10+ years experience

registered

₹150 Cr

AUM

HDFC Bank Limited is a prominent private bank in India, offering a wide range. Read More

Why Invest in global leaders?

Global Growth

Invest in high-growth sectors like AI, EV, Biotech, and Robotics through a focused global portfolio not available in traditional domestic funds.

Innovation Driven

Gain access to innovation-driven global stocks aligned with themes like “Data is the New Oil,” offering opportunities beyond local markets.

Expert Review & Rebalancing

Every basket is reviewed by investment experts and rebalanced periodically to stay aligned with market shifts and investor goals.

Transparent & Trackable

Each basket is SEBI-compliant, performance-tracked, and easy to monitor from your dashboard.

Portfolio Facts

Lock-in Period

None

Annual Management Fee

2.5% (Incl. GST)

Min. Initial Investment

₹ 10 Lacs

Min. Additional Investment

₹ 85,000

Market Cap. Restriction

Above $10 Billion

Get Your

AI-Powered Portfolio

Get Portfolio

13:13

stack wealth / 2025

Stack Wealth is an AI powered wealth management platform that simplifies finance management. It helps users make better decisions with personalised recommendations and a unified portfolio view.

Role

Lead Product Designer

Investment Purpose Statement

01/02

The Investment Purpose Statement (IPS) turns simple inputs into a meaningful financial profile. Instead of focusing only on numbers, it interprets the intentions behind decisions, capturing the why as much as the what.

By mapping goals like long-term growth, vacations, or liquidity needs, the IPS organizes scattered inputs into clear, structured insights. It connects everyday choices to broader financial objectives.

The result is a personalized profile that reflects both financial behavior and life goals, ensuring strategies feel relevant, motivating, and actionable.

Your investments should align with your life goals

Tell us what you're planning for—whether it's early retirement, a new car, or a dream vacation. We'll help you invest accordingly.

Select your goals

13:13

Do you need to withdraw this money anytime soon?

Tell us what you're planning for—whether it's early retirement, a new car, or a dream vacation. We'll help you invest accordingly.

Select your goals

13:13

Strategies

02/02

Based on each profile, users receive personalized strategies that turn their goals into clear direction. Flagship builds a balanced foundation, Global Leaders drives international growth, and Opportunity captures high-potential emerging trends.

Flagship

Strategy

Flagship is your core portfolio to achieve long-term wealth growth for you.

CAGR

22.4%

Min. Investment

₹ 35,000

Global Leaders

Strategy

With Global Leaders, you can invest in global stocks and diversify your portfolio.

CAGR

22.4%

Min. Investment

₹ 50,000

Opportunity Strategy

Invest in AI, Green Energy, and Tech innovations for long-term portfolio success.

CAGR

22.4%

Min. Investment

₹ 25,000

Each strategy comes with tailored investment recommendations aligned to the IPS. Long-term investors may see equity-heavy options, while those prioritizing liquidity get safer, flexible choices — all showing how each decision supports their goals.

Strategies also rebalance over time. As markets or personal needs change, portfolios are adjusted to stay aligned, reducing risks and keeping investments optimized for performance.

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+63%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹13700-15200

Review Range (3Y)

₹3059-3259

HDFC Bank Ltd

Buy

Upside

+24%

HDFC Bank Ltd

Exit

Portfolio Booked

+24%

MAR 2025

jan 2025

Custom Strategies

Built an AI-powered system that delivers personalized investment strategies based on individual preferences and goals, while driving higher product engagement and improving user session flow.

Long-Term

The Portfolio targets medium to long-term growth by investing in global leaders in sectors like AI, EVs, and Renewables.

Performance

Investments

Rebalances

Managed by

Facts

Performance vs Benchmarks

INR

USD

Our Strategy (Global Leaders)

6.12%

4.93%

3.10%

S&P 500

NIFTY 50

1M

YTD

1Y

3Y

Inception

Buy Recommendations

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+75%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

View all

Metrics

P/E Ratio

Portfolio

2.38%

Nifty500

1.8%

-10%

10%

higher the better

ROCE (%)

Portfolio

-2.38%

Nifty500

1.8%

-10%

10%

higher the better

Price/Book Ratio

Portfolio

1.5

Nifty500

0.9

-20%

15%

lower the better

Current Ratio

Portfolio

1.8

Nifty500

1.2

+5%

10%

higher the better

Net Profit Margin (%)

Portfolio

5.0%

Nifty500

4.0%

+15%

20%

higher the better

Sector Split of this Strategy

Sectors

Sector Wise Break-up

Technology

53%

Healthcare

11%

Consumer Discretionary

25%

View Split

Recent Calls

Stable assets are low-volatility investments that provide steady returns.

MAR 2023

Exit

HDFC Bank Ltd

Portfolio Profit

+24%

MAR 2023

Buy

HDFC Bank Ltd

Upside

+24%

JAN 2024

HDFC Bank Something Ltd

Allocation

-24%

JAN 2024

HDFC Bank Something Ltd

- 2%

View all

Managed by

Ketul Sakhpara

25+ years experience

registered

Ketul Sakhpara, CFA is the Founder of BayFort Capital with over 20 years of experience. Read More

Niranjan

10+ years experience

registered

₹150 Cr

AUM

HDFC Bank Limited is a prominent private bank in India, offering a wide range. Read More

Why Invest in global leaders?

Global Growth

Invest in high-growth sectors like AI, EV, Biotech, and Robotics through a focused global portfolio not available in traditional domestic funds.

Innovation Driven

Gain access to innovation-driven global stocks aligned with themes like “Data is the New Oil,” offering opportunities beyond local markets.

Expert Review & Rebalancing

Every basket is reviewed by investment experts and rebalanced periodically to stay aligned with market shifts and investor goals.

Transparent & Trackable

Each basket is SEBI-compliant, performance-tracked, and easy to monitor from your dashboard.

Portfolio Facts

Lock-in Period

None

Annual Management Fee

2.5% (Incl. GST)

Min. Initial Investment

₹ 10 Lacs

Min. Additional Investment

₹ 85,000

Market Cap. Restriction

Above $10 Billion

Get Your

AI-Powered Portfolio

Get Portfolio

13:13

stack wealth / 2025

Stack Wealth is an AI powered wealth management platform that simplifies finance management. It helps users make better decisions with personalised recommendations and a unified portfolio view.

Role

Lead Product Designer

Investment Purpose Statement

01/02

The Investment Purpose Statement (IPS) turns simple inputs into a meaningful financial profile. Instead of focusing only on numbers, it interprets the intentions behind decisions, capturing the why as much as the what.

By mapping goals like long-term growth, vacations, or liquidity needs, the IPS organizes scattered inputs into clear, structured insights. It connects everyday choices to broader financial objectives.

The result is a personalized profile that reflects both financial behavior and life goals, ensuring strategies feel relevant, motivating, and actionable.

Your investments should align with your life goals

Tell us what you're planning for—whether it's early retirement, a new car, or a dream vacation. We'll help you invest accordingly.

Select your goals

13:13

Do you need to withdraw this money anytime soon?

Tell us what you're planning for—whether it's early retirement, a new car, or a dream vacation. We'll help you invest accordingly.

Select your goals

13:13

Strategies

02/02

Based on each profile, users receive personalized strategies that turn their goals into clear direction. Flagship builds a balanced foundation, Global Leaders drives international growth, and Opportunity captures high-potential emerging trends.

Flagship

Strategy

Flagship is your core portfolio to achieve long-term wealth growth for you.

CAGR

22.4%

Min. Investment

₹ 35,000

Global Leaders

Strategy

With Global Leaders, you can invest in global stocks and diversify your portfolio.

CAGR

19.4%

Min. Investment

₹ 50,000

Opportunity Strategy

Invest in AI, Green Energy, and Tech innovations for long-term portfolio success.

CAGR

38.2%

Min. Investment

₹ 25,000

Each strategy comes with tailored investment recommendations aligned to the IPS. Long-term investors may see equity-heavy options, while those prioritizing liquidity get safer, flexible choices — all showing how each decision supports their goals.

Strategies also rebalance over time. As markets or personal needs change, portfolios are adjusted to stay aligned, reducing risks and keeping investments optimized for performance.

Potential Upside

+75%

Varun Beverages Limited

Closing price of ₹1808.9 on 20 May 2025

Allocation

23%

Buying Range

₹1700-1900

Review Range (3Y)

₹3059-3259

Potential Upside

+63%

Amazon.co Inc

Closing price of ₹1808.9 on 20 May 2025

Allocation

19%

Buying Range

₹13700-15200

Review Range (3Y)

₹3059-3259

HDFC Bank Ltd

Buy

Upside

+24%

HDFC Bank Ltd

Exit

Portfolio Booked

+24%

MAR 2025

jan 2025